Revolutionarily low fees

Our transparent Onefee model is designed to give you a lot more out at the end of the day. Don’t let high fees ruin your investment growth!

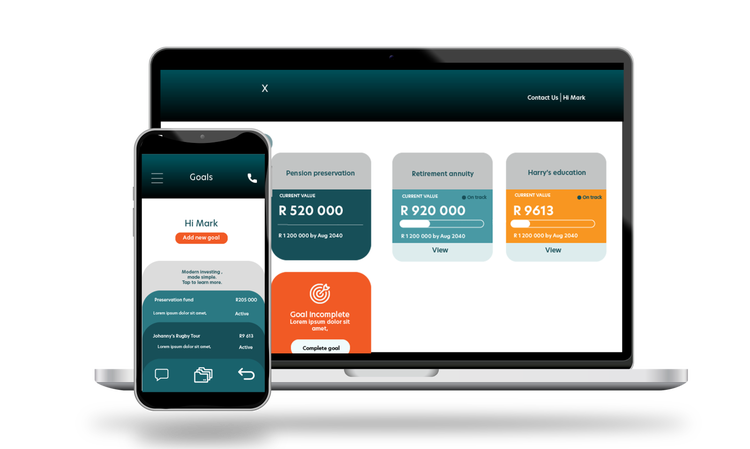

Investment made simple

Start or transfer a tax-free investment with ease, and once you’re set up you can effortlessly manage your investment on our app or from our website.

Stay on track

Our world-class tracking software makes it easy to track your investment progress while closely watching your performance to help you achieve your investment goal.

Candace pays 54% less in fees. She could get over

R58 000 more out of her tax-free investment.

Profiles used are only for illustrative purposes. The examples provided compare our Onefee to investments applying a 3% per annum fee model. These include fees for advice, administration and fund management. The results are modelled based on a historical growth rate using the asset allocation of the CoreSolutions Moderate fund. Research on fees was conducted by Alexforbes Invest internally. Past performance is not indicative of future performance. All investments are exposed to risk, not guaranteed and dependent on the performance of the underlying investments and excludes the impact of Securities Transfer Tax. Fees may change due to inflation.

Frequently asked questions

Yes, you may want to set up different tax-free investments to help you with different goals in life. For example, you can set up separate education funds for each of your children that you may want to withdraw from at different life stages.

Remember, that a total contribution limit of R36 000 per year and a maximum lifetime contribution of R500 000 applies to the combined contribution amount on tax-free investments that are in your name.

Yes. As of 1 March 2018, you can transfer your existing tax-free investment to another service provider, without having to worry about your contribution limit.

However, please contact us so we can advise you on the best process to follow and on any possible financial implications.

Download the Alexforbes Invest app, and our online Digital-Adviser will ask you a couple of questions to get to know a bit about your investment goals and financial circumstances.

The system will then recommend an investment fund that best caters to your specific needs.

You're not under any obligation to invest at that point, but it'll give you a better idea of what investment outcomes you could achieve with our tax-free investment plan.

By law, there are certain limits to how much you can invest in a tax-free investment account that's been set up in your name. You can invest up to R36 000 per tax year, with a lifetime limit of R500 000. These limits apply to your combined tax-free investment policies.

If you invest more than the allowed amount in a tax year, you'll be taxed at 40% for all amounts above R36 000. That's why we’ve put measures in place to make sure that your combined Alexforbes Invest tax-free contributions do not exceed the yearly limit.

We can only keep track of contributions into Alexforbes Invest accounts, and we advise you to keep track of all the contributions you make into tax-free accounts with other service providers to ensure that you stay within the R36 000 yearly limit.

Yes, you can make withdrawals as often as you want. That said, a tax-free investment plan is intended for long-term investments with a significant tax benefit.

Also, if you withdraw a certain amount from your investment with the idea of putting it back later, this ‘replacement’ will be added onto the amounts considered for your yearly and lifetime limit.

Once you’ve reached your lifetime limit (R500 000 in contributions) you don't have to withdraw your investment and can leave the money in the investment account to grow even further.

Some tax-free investment accounts only invest in cash, whereas the Alexforbes Invest Tax-free Investment Plan lets you invest in funds with exposure to listed property, stocks, cash, and bonds to increase your exposure and manage your risk.

Our fee structure differs in that we only charge one fixed fee that you see on your statement in rands and cents. This is our way of keeping our investment fees as low and transparent as possible.