Up to 90% offshore equity exposure

If you favour more offshore exposure, take up the Alexforbes Invest Living Annuity and you can allocate up to 90% of your investment in offshore equity.

Our Onefee model

High investment fees can limit the success of your investment. With our Onefee, you pay less, which means you could get more out at retirement. Find out more here.

Outcomes-based investing

Stick to your retirement goals by tracking your investment's outcomes in real-time.

Want to design your own investment portfolio in retirement?

Our systems automatically suggest a suitable investment fund for your income in retirement, but you can also build your own combination from the funds available on the platform and get an instant estimate of your income in retirement.

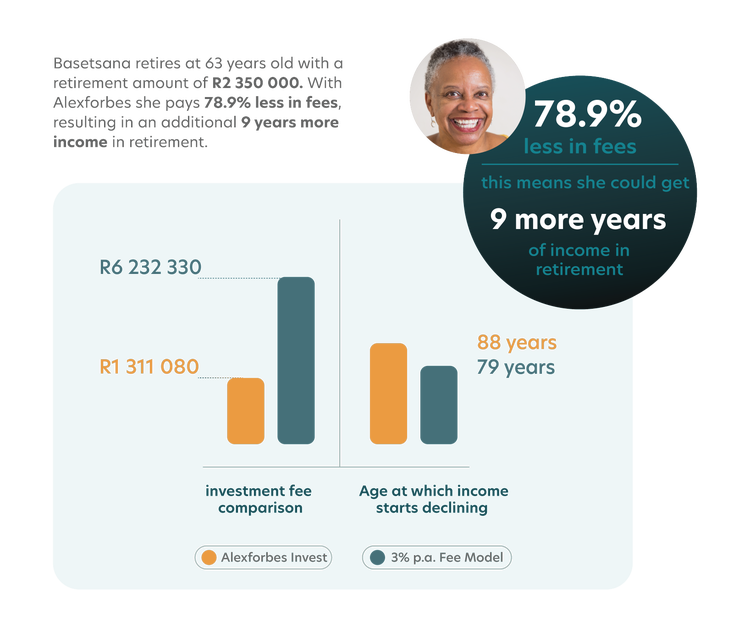

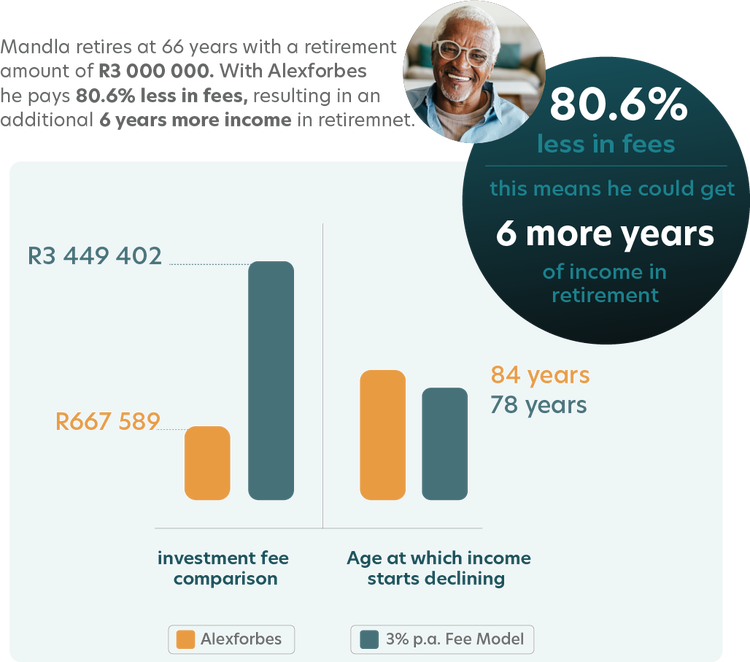

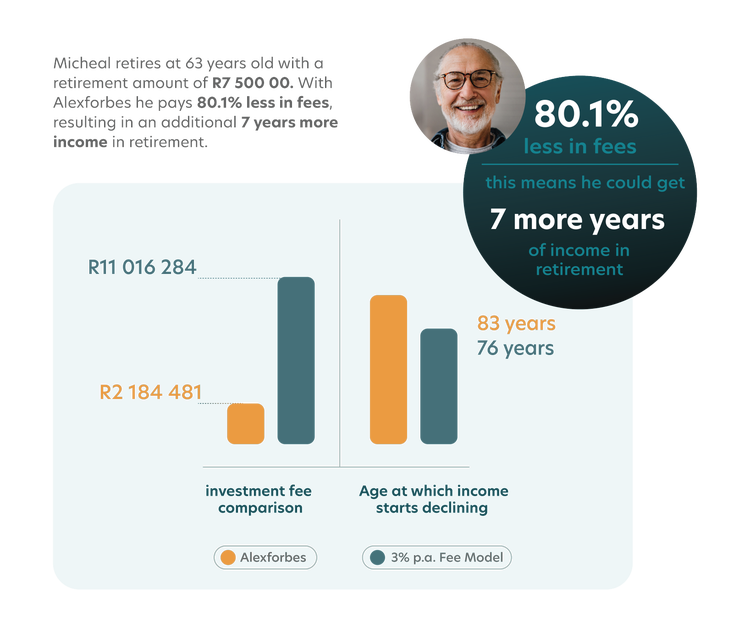

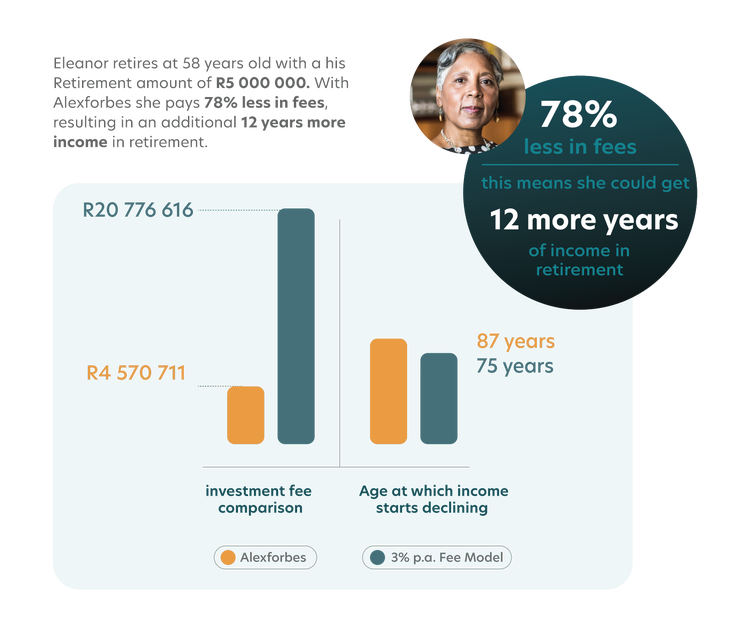

Get more years of income at retirement

Browse through some examples of how the Alexforbes Invest Living Annuity's low fees could contribute to more years of income at retirement, when compared to investments that apply a 3% p.a. fee model.

Profiles used are only for illustrative purposes. These figures include fees for advice, administration, fund management and other costs. We use the same return estimate when comparing investments applying a 3% fee model and an investment with Alexforbes Invest on various portfolio options, the only difference being the applicable fees. Modelling excludes the impact of taxes (including securities transfer tax). Research on fees was conducted by Alexforbes Invest internally. Past performance is not indicative of future performance. All investments are exposed to risk, not guaranteed and dependent on the performance of the underlying investments. Fees may change due to inflation.

Frequently asked questions

Every time you withdraw money from your living annuity, the administrator will hold back an estimate of taxes due and will pay the balance to you. This type of tax is known as income tax or Pay As You Earn (PAYE).

All the investment growth, income or capital gains are free of tax inside the Alexforbes Invest Living Annuity.

In some instances, you may decide that you would prefer the safety of a fixed income for the remainder of your life. To achieve this, you are able to convert your existing Alexforbes Invest Living Annuity to a life annuity. However, once you have converted your living annuity to a life annuity, you may not convert it back. If you would like to know more about this, please get in touch with your financial adviser, if applicable, or call Alexforbes Invest to discuss this in more detail.

The Alexforbes Invest Living Annuity is underwritten by Alexander Forbes Investments Limited, a licensed insurer and FSP.