Get more out at retirement with Onefee

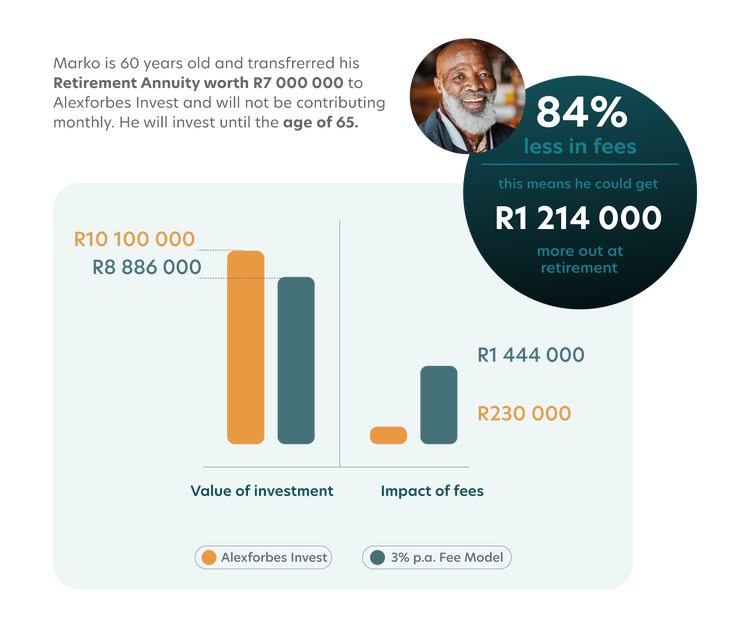

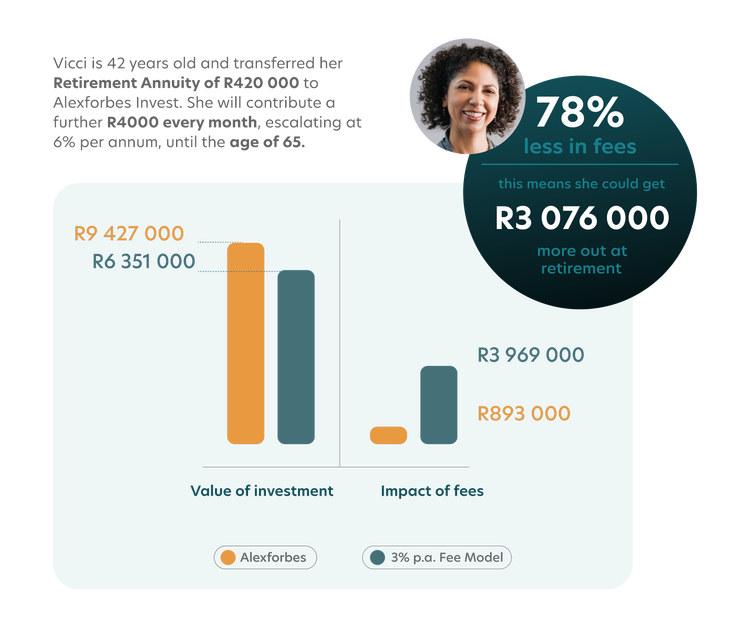

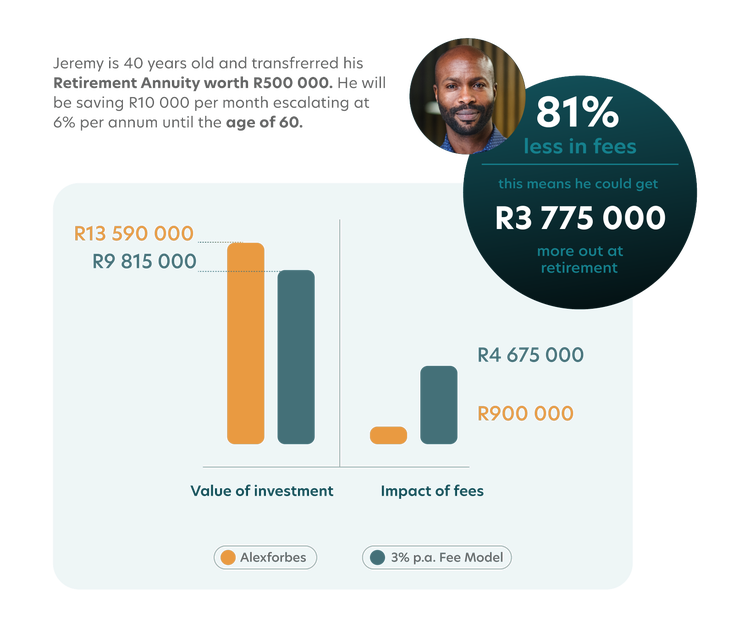

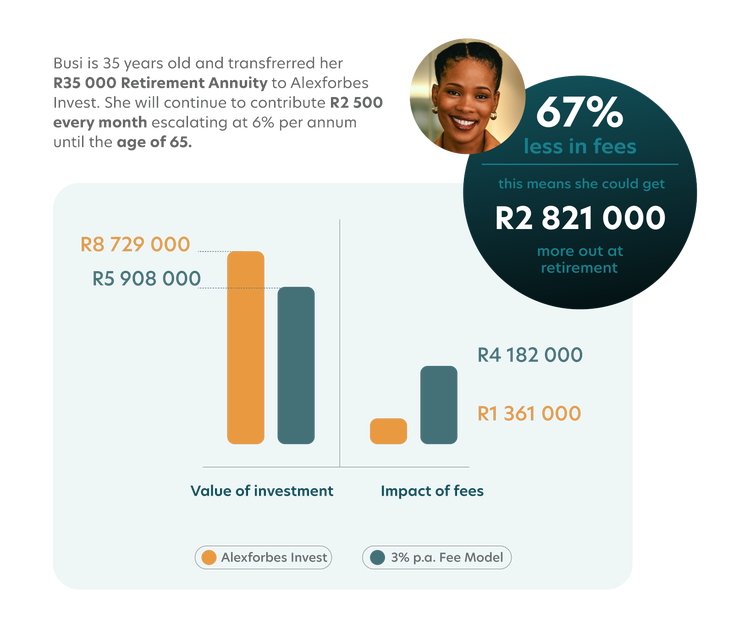

Browse through some examples of how our Onefee, in combination with our retirement annuity, makes all the difference to your outcome at retirement.

Profiles used are only for illustrative purposes. The examples provided compare our Onefee to investments applying a 3% per annum fee model. These include fees for advice, administration and fund management. The results are modelled based on a historical growth rate using the asset allocation of the CoreSolutions Moderate fund. Research on fees was conducted by Alexforbes Invest internally. Past performance is not indicative of future performance. All investments are exposed to risk, not guaranteed and dependent on the performance of the underlying investments and excludes the impact of Securities Transfer Tax. Fees may change due to inflation.

Switch and save

Thanks to our Onefee model, you could save a massive amount in fees, leaving more of your money to grow. And that could result in a lot more at retirement. Find out more here.

Great tax benefits

Your contributions to a retirement annuity fund are tax-deductible and the returns you earn on your investment are tax-free.

Outcomes-based investing

We'll help you stick to your retirement goals by monitoring your retirement annuity in real-time.

Frequently asked questions

The law allows an investor to deduct contributions to retirement funds (pension, provident and retirement annuities) of up to 27.5% of their taxable income or gross income whichever is higher to qualify for a tax deduction. This 27.5% limit is not per retirement fund but cumulative (aggregated) across all retirement funds.

There is an annual maximum tax-deductible threshold of R350 000, however, all contributions over this threshold can be carried over and used in future years, limited to the applicable restrictions in those years.

Basically, Regulation 28 (Reg 28) of the Pension Funds Act, means that you can’t invest more than 75% in equities, 100% in cash, 25% in immovable property, 10% in Commodities (Kruger Rands, gold) or 15% in Hedge funds within a retirement annuity. But you need not worry as all our funds in the Alexforbes Invest Retirement Annuity are Reg 28 compliant.

The intention of Reg 28 is to ensure that investors are not overexposed to unnecessary concentration risk with their retirement money.

Your Retirement Annuity will reflect 4 components, being a Retirement, Savings, Vested and Non-vested component.

Your contributions will be split into two of the components. One third will go into the Savings component and the other two-thirds into the Retirement component. The remaining components will only reflect the value of contributions made before 1 September 2024, and growth thereon.

For more information, you can click here.

On retirement

The earliest you can retire from a Retirement Annuity (RA) is age 55 (unless in the event of death, disability or formal immigration). When you retire (as from 1 September 2024) you have the following options from the various components in your RA:

- Non-Vested component

You can take up to 1/3rd of your money in cash subject to tax. You must use at least 2/3rds of your money to purchase an annuity to provide you with an income in retirement.

- Savings and Vested component

You can take the full amount in cash (subject to tax) or use this or a portion towards purchasing an annuity to provide you with an income in retirement.

- Retirement component

You must use your entire amount in your retirement component to purchase an annuity that will provide you with an income.

- Amounts less than R 165 000 at retirement in your RA:

If the full amount in your Retirement component plus 2/3rds of the non-vested component is below R 165 000, you can take the entire amount in cash subject to tax.

When withdrawing

The following applies to withdrawals before you formally retire from an RA (as from 1 September 2024):

- Savings component

Withdrawals from the Saving component can be done once every tax year, subject to tax at your marginal tax rate, subject to a minimum amount of R2 000.

- Vested and Retirement component

You can only withdraw from the Vested and Retirement component if you have formally emigrated, subject to emigration rules and applicable tax.